Discover All the Essential Information About High Cholesterol Life Insurance in 2025 + YouTube Video

Are you concerned about getting life insurance with high cholesterol? We understand that having high cholesterol can worry people when planning on applying for new life insurance coverage.

worry people when planning on applying for new life insurance coverage.

That’s why we’ve partnered with multiple highly rated life insurance companies that specialize in providing coverage for individuals with this condition.

At our office, the purchase of life insurance is a simple and straightforward process. We work diligently to find you the best options available, even with higher than normal cholesterol levels.

Our friendly and experienced team will guide you through the entire application process, ensuring that you receive the coverage you need at the best rates possible.

We can help you secure the best life insurance with high cholesterol, regardless of your lab results.

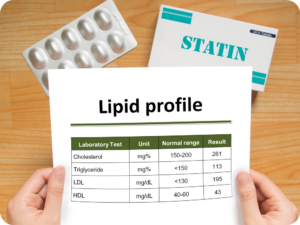

Reminder: LDL (low-density lipoprotein) is the “bad” form of cholesterol. HDL (high-density lipoprotein) is a “good” form of cholesterol.

Table of Contents

- Does High Cholesterol Affect Life Insurance Rates?

- Can You Get Life Insurance With High Cholesterol?

- YouTube Video: Medical Conditions

- Will Taking Statin Medication Increase My Rates?

- How Can I Reduce My Cholesterol Naturally?

- What Is Considered High Cholesterol?

- Best Companies for High Cholesterol

- Our Final Thoughts

Can You Get Life Insurance With High Cholesterol?

Can you get life insurance with high cholesterol? To answer this simple question? The answer is yes, and usually with no problem at all. If your cholesterol levels are within normal limits, you can get preferred rates considering your overall health is acceptable.

Also, if your limits are higher than average, you could be classified in a Standard Plus or a Standard rating which is still very affordable. If your levels used to be high and you are now taking medication that brings them down to a safe level, you may even qualify for preferred rates.

Insurers are mainly concerned that high levels could easily lead to artery restrictions, which could trigger a fatal heart attack or stroke. Most applicants do not have any problems buying life insurance policies for high cholesterol unless their condition is out of control.

How to Apply for Life Insurance With a Medical Condition: YouTube Video

Carrier Concerns with High LDL Levels

This is a dangerous form of bad cholesterol that clogs arteries and can cause strokes and heart attacks.

Life insurance companies understand that this can be a serious condition if left untreated. They consider elevated cholesterol levels a possible beginning of heart disease or stroke. Cholesterol is a waxy substance found in fats, otherwise known as lipids, in your blood.

Although your body needs cholesterol to continue to build healthy blood cells, having too much can drastically increase your risk of heart disease. Heart disease is the number one killer in the United States. Heart disease kills more people each year than cancer.

Individuals with this condition may develop dangerous fat deposits in their blood vessels. These deposits make it very difficult for a lot of blood to flow through their arteries as time passes. A heart that does not have enough oxygen-rich blood will increase the risk of a heart attack.

A shortage of blood to one part of the brain can cause a stroke. Strokes can be just as quick and fatal as heart attacks. High cholesterol can be inherited, but it’s often the result of unhealthy lifestyle choices and is thus preventable and treatable. A healthy diet, regular exercise, and sometimes medication can significantly reduce levels.

Will High Cholesterol Affect My Life Insurance Rates?

Life insurance rates for this condition will be based on the level of your risk and your overall health. If you have mild to moderately elevated levels and they are controlled with medication, you will probably see no increase in your premiums. You should have no problem getting affordable life insurance as long as your health is under control and stable.

Even if your levels are slightly high and you don’t take any medication, you will probably still qualify for preferred rates, mainly if you apply with the best life insurance companies.

Suppose your condition is more severe and is not being controlled with medication. You will then see an increase in premiums by adjusting your health classification accordingly. Also, being overweight and using tobacco products will fuel the fire. Having multiple health conditions simultaneously will usually promote a higher rate increase and sometimes a decline.

Will Taking Statin Medication Increase My Rates?

Taking medication to improve lowering your levels is a positive move, which shows the underwriters that you periodically see a doctor and improve your health.

doctor and improve your health.

A person with this condition seldom sees a doctor without ever taking medication and will have problems. Insurance companies do not appreciate the idea of ignoring one’s health.

If possible, improve your diet, lose some weight, and exercise more. This, in many cases, can eliminate your medical issues and the need for medications along with their side effects. Remember that statin drugs used to treat elevated cholesterol have a long list of severe side effects.

How Can I Reduce My Cholesterol Naturally?

If you are diagnosed with this condition, the first step should always be an attempt to reduce your cholesterol levels naturally, such as:

levels naturally, such as:

Start Eating Heart-Healthy Foods

1. Eat more whey protein

2. Increase your soluble fiber intake

3. Increase your Omega-3 fatty acid intake

4. Decrease or eliminate trans fats

5. Reduce eating saturated fats

If You Smoke, Try to Quit

If you stop smoking, it will reduce your blood pressure and heart rate within minutes. Your body’s blood circulation and respiratory system will increase within a few months. You will drastically reduce the risk of heart attack or coronary heart disease within a year. After six months, the risk of having a major stroke was reduced by over 60%.

Stop or Reduce Your Alcohol Intake

Limiting your alcohol intake to no more than one drink daily can increase your HDL cholesterol (good cholesterol) by a maximum of 1-2 drinks daily.

Too much alcohol can drastically increase the risk of heart disease, hypertension, and stroke. If you consume a lot of alcohol, your chances of ever lowering your cholesterol are slim.

If You Are Overweight, Lose a Few Pounds

Try to eliminate as much sugar as possible. This includes candy, soda pop drinks, and many types of food you eat, such as apples and oranges, which contain a lot of sugar.

Also, many bread products have a high degree of sugar after eating. The dangers of sugar in the body are intense and should not be overlooked.

Getting involved in cardiovascular exercises such as fast walking and jogging, and staying more active on your feet will help.

Be careful of fattening foods such as fast-food restaurants. Instead, research what foods to eat and what not to eat.

Weightlifting is one of the best ways to burn calories and burn off body fat, including lowering your cholesterol levels.

What Foods Should I Avoid Eating?

It is essential to pay attention to foods to avoid this condition. You can reduce your harmful LDL levels by just taking a moment to research food on the internet. Learn more about what foods to eat and what to avoid.

taking a moment to research food on the internet. Learn more about what foods to eat and what to avoid.

With all the side effects of statin drugs, taking the bull by the horns and watching what you eat will pay off.

If you add more physical exercise to your lifestyle, you can reduce it even more.

Then, when the smoke clears, you could look at perfectly normal levels. Here is just a sample of foods to avoid. Remember, eating these foods in excess is where the cholesterol problems start.

Limit These Foods to Lower Your Cholesterol

1. Egg yolks, including whole eggs (eaten regularly)

2. Butter (if consumed in excess)

3. Shellfish family of foods, examples: lobsters, oysters, and shrimp

4. Beef and pork-related are limited to (fatty cuts of meat)

5. Salmon and other fish are known to be greasy and fried

6. Cheese, cream, and sour cream (unless they are low-fat versions)

7. Organ-related meat, such as liver, which is the worst

8. Bacon and sausage, along with other (processed meats)

What Is Considered High Cholesterol for Life Insurance?

Anytime an individual applies for life insurance, medical underwriters review your cholesterol levels as part of the underwriting process to determine your overall health and risk factors. All life insurance carriers have their own guidelines to follow.

Below you will find the main categories that the underwriters are concerned with which are classified in ratios.

Total Cholesterol:

Preferred range should be below 200 mg/dL

Borderline high range 200–239 mg/dL

Considered high risk to be 240 mg/dL or higher

LDL Reading –

LDL is your bad cholesterol:

Preferred range is below 100 mg/dL

Borderline high is 130–159 mg/dL

High risk is 160 mg/dL or higher

HDL Reading –

HDL is your good cholesterol:

Preferred range is 60 mg/dL or higher

The lower range is less than 40 mg/dL for men and less than 50 mg/dL for women

Cholesterol Ratio –

This is your total HDL ratio:

Recommended – less than 5:1

Excellent – 3.5:1

How High Cholesterol Affects Rating Classifications

Preferred Rates:

Individuals with total cholesterol levels under 200 mg/dL and a very favorable ratio (around 3.5:1) are more likely to receive preferred or super-preferred rates, which are associated with lower premiums.

Standard Rates:

If your cholesterol level is slightly elevated, but not in the risky category, such as total cholesterol in the 200–239 mg/dL range with a healthy HDL, you may qualify for standard rates.

Substandard Rates with Rate Tables:

Higher levels of cholesterol above 240 mg/dL or a poor LDL to HDL ratio could result in higher premiums due to the additional risk.

Most carriers will take into consideration that your cholesterol is being controlled with high cholesterol medication which will allow you to be approved with very good rates.

If you are assigned a standard rating with a rating table that would be categorized with the letters A through J, this chart will reflect the rate adjustments in percentages. Most rate increases we see for high cholesterol are usually very mild.

Life Insurance Rate Table Comparison

Rate Table Letter

Percentage Increase

A

Plus 25%

B

Plus 50%

C

Plus75%

D

Plus 100%

E

Plus 125%

F

Plus 150%

G

Plus 175%

H

Plus 200%

I

Plus 225%

J

Plus 250%

Best Life Insurance Companies for High Cholesterol

Banner Life –

Banner is one of our favorite companies that offers applicants Preferred Plus rates if you have a cholesterol ratio of no more than 4.5—with a total level not exceeding 300.

Rates over 4.5 but under 5.5 can qualify for Preferred rates, which are still an excellent rate class.

Remember that Preferred Plus rates will be limited to people in perfect health. Those under 6.5 are eligible for Standard Plus. Standard rates are offered to those with higher ratios under 8.0, with total cholesterol levels still below the 300 range.

Voya –

Men with ratios below 5.0 (with total cholesterol below 300) can qualify for their Preferred Plus rates. Meanwhile, women under 4.5 are eligible for the same rates. Requirements are getting tighter for their Preferred rates, with 5.5 being the limit for men and 5.2 for women.

Those with ratios no higher than 6.0 can still qualify for their Standard ratings. Voya offers some of the best life insurance coverage for high cholesterol.

Prudential –

Applicants with ratios of no more than 5.0 are eligible for Prudential’s Preferred Plus rates. Meanwhile, those with a ratio of no more than 6.0 will be placed in the Preferred rate class. Those with ratios no higher than 7.0 are eligible for Standard Plus.

The company also allows total cholesterol levels for all of its health classes to go up to 300. We have found that the Prudential Life insurance company is another excellent choice for many applicants since they are more liberal with their requirements than most other companies.

Our life insurance companies do a great job of underwriting applications for people with high cholesterol and as long as your condition is controlled, you may receive preferred rates.

What Are the Medical Symptoms of High Cholesterol?

The downside of this medical condition is that it has no symptoms. Only a blood test will detect high cholesterol. The lack of symptoms is why so many people walk around with it and don’t even know it. It is very similar to high blood pressure in that respect.

Many people don’t go to the doctor regularly and never even know they have high cholesterol until they apply for a life insurance policy and then they get a surprise when their physical exam results come back from the lab. Fortunately, there are a lot of good life insurance options for people with high cholesterol.

What Does the Term “Total Cholesterol” Signify?

The meaning of the phrase “total cholesterol” is simply a measurement of the “total” amount of cholesterol in your blood system. The phrase entails low-density lipoprotein (LDL) and high-density lipoprotein (HDL).

The LDL version is the bad version that can cause a blockage in the arteries of your body. It is one of the leading causes of strokes and heart attacks.

Reasons for High Cholesterol Levels

Cholesterol travels through your bloodstream and attaches to proteins in your blood. This combination of proteins and cholesterol is a lipoprotein.

The different types of cholesterol are based on what kind of cholesterol the lipoprotein carries throughout the bloodstream. For example, low-density lipoprotein LDL, the bad version, spreads these particles throughout your body.

The dangerous LDL builds up in the walls of your arteries, making them hard and narrow to the point of blood flow restriction. Unfortunately, this also promotes high blood pressure.

What Are the Factors That Cause Elevated Cholesterol Levels?

Smoking:

All forms of tobacco can damage the interior walls of your blood vessels. If this occurs, they can quickly accumulate fatty deposits.

Smoking also lowers your HDL level, or “the good” form. Smoking will also add a tobacco rate to your rates, increasing by over 200% percent.

Diabetes:

High blood sugar, caused by diabetes, contributes to higher LDL and lower HDL cholesterol. High blood sugar levels can severely damage the lining of your arterial walls.

Obesity:

Being overweight or obese can significantly put you at risk of developing high cholesterol.

Insufficient Exercise:

Physical exercise will increase your body’s HDL. This will increase the size of the particles that make up your LDL bad cholesterol, making it less harmful to your health.

Unhealthy Diet:

Consuming too much saturated fats found in animal-related products. The fats found in commercially baked cookies can raise your levels. Foods high in cholesterol, such as red meat, beef and pork, and fatty dairy products, can also increase your total levels.

Examples of Normal Levels of Cholesterol

1. Total cholesterol Less than 200 mg/dL

2. LDL “bad” cholesterol Less than 100 mg/dL

3. HDL “good” cholesterol of 40 mg/dL or higher

4. Triglycerides Less than 150 mg/dL

You can fall into the readings such as these with or without cholesterol medications. You will be in good shape once you start your application process. For some reason, the insurance companies’ offers for life insurance are not as good as expected. Sending your application to other companies is always an option.

Carrier Concerns with High LDL Levels

This is a dangerous form of bad cholesterol that clogs arteries and can cause strokes and heart attacks.

Life insurance companies understand that this can be a serious condition if left untreated. They consider elevated cholesterol levels a possible beginning of heart disease or stroke. Cholesterol is a waxy substance found in fats, otherwise known as lipids, in your blood.

Although your body needs cholesterol to continue to build healthy blood cells, having too much can drastically increase your risk of heart disease. Heart disease is the number one killer in the United States. Heart disease kills more people each year than cancer.

Individuals with this condition may develop dangerous fat deposits in their blood vessels. These deposits make it very difficult for a lot of blood to flow through their arteries as time passes. A heart that does not have enough oxygen-rich blood will increase the risk of a heart attack.

A shortage of blood to one part of the brain can cause a stroke. Strokes can be just as quick and as fatal as heart attacks. High cholesterol can be inherited, but it’s often the result of unhealthy lifestyle choices and is thus preventable and treatable. A healthy diet, regular exercise, and sometimes medication can significantly reduce levels.

What Kind of Foods Lower Cholesterol Levels?

Oats:

Oatmeal and oat-based cereals, such as Cheerios, are a big favorite.

Barley & Whole Grains:

This would include foods such as oat bran-related foods.

Beans:

Navy, kidney, beans, lentils, garbanzos, black-eyed peas, and others.

Eggplant & Okra:

These two foods are low-calorie vegetables that are good sources of soluble fiber.

Nuts:

Eating almonds, walnuts, peanuts, and other nuts is good for the heart. Consuming 2 ounces of nuts a day can slightly lower LDL. Nuts also have additional nutrients that protect the heart.

Vegetable Oils:

Consuming liquid vegetable oils such as canola, sunflower, safflower, and others in place of butter or shortening when cooking can lower LDL.

Apples, Grapes, Strawberries, and Citrus Fruits:

These foods are rich in pectin, a soluble fiber that helps lower LDL.

Soy:

Adding soybeans and foods made from them, like tofu and soy milk, to your menu is an excellent way to lower cholesterol.

What Are the Three Main Types of Life Insurance?

Term Life Insurance:

Term life insurance will always have the lowest cost and allow you to get the highest face amount you may need without breaking the bank. You can choose life insurance products with a term of 10 to 40 years. These policies can also be converted into permanent life insurance during the lifetime of your term policy period.

Universal Life:

Universal life insurance is a permanent life insurance product that will last for the rest of your life as long as you keep paying your premiums. It does cost over double the price of a term policy, but it will last the rest of your life with no possible gaps in coverage like a term policy can.

No-Medical-Exam Life Insurance:

No medical exam life insurance is also known as Non-Med life insurance. The application is shorter than a conventional plan design, and the physical exam is also waived. The downside is that these plans cost more than traditional term policies. I would recommend the standard application option to keep the premium as low as possible.

How to Compare the Best Rates

Compare the best high cholesterol life insurance quotes from over 40 top-rated companies using our website’s instant rate comparison system. You can see which companies offer the lowest rates in less than a minute.

You can also call us; we will help you over the phone or by email. Always remember that any medical conditions you have can impact your rates. We can determine your projected rates if you apply after a brief conversation.

Estimating premiums for life insurance with high cholesterol levels usually requires us to contact several carriers to get their input so we can provide you with accurate rates instead of simply guessing. This will provide us with accurate high cholesterol life insurance options for you to consider.

Our Final Thoughts

If you are looking for the best life insurance for individuals with high cholesterol, look no further. Locate the best rates from one of the 40 top rated companies we work with every day. Our quoting system will instantly display the rates side-by-side for easy comparison.

You will find that life insurance with this condition can be very affordable, especially when you have an excellent chance of getting preferred rates. Feel free to contact us and get all the answers to your questions seven days a week.

All the best,

Jack Venturi

Should you have any questions or need further assistance, please don’t hesitate to call us at 708-334-6226 for a prompt response.